Weekly Market Highlights

11th of December 2025

This week brought a wave of momentum across the MENA startup ecosystem, with founders pushing boundaries, attracting new capital, and expanding into high-growth markets.

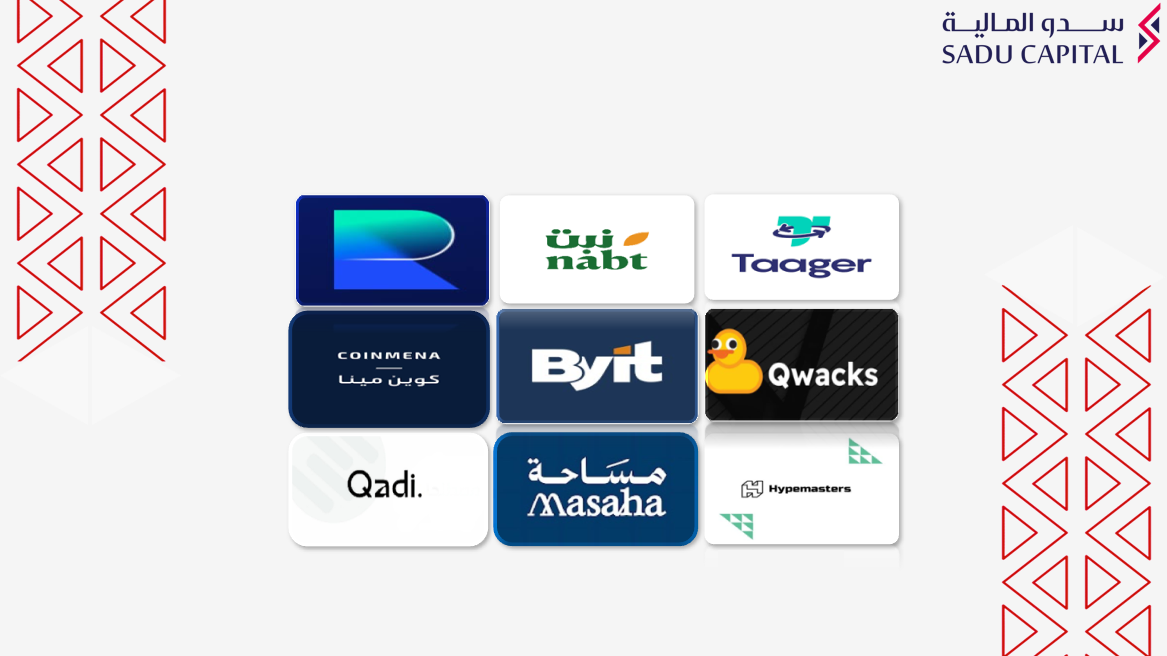

UAE-based renovation tech startup Reno has raised $4 million in equity and debt from investors including 500 Sanabil, Hub71, Plus VC, and others. Founded in 2024, Reno offers an end-to-end renovation platform with AI-powered design, project management, and financing. The funding will support GCC expansion, technology development, and the launch of its new AI-driven app in 2026.

Saudi agritech startup Nabt has secured $3.4M in a seed extension round led by SHG Group with continued backing from Merak Capital, bringing total funding to $5M. Founded in 2022, Nabt operates a B2B marketplace connecting farmers with businesses, supported by digital tools and cold-chain logistics. The new capital will fuel Nabt’s expansion into more Saudi cities, growth of its product portfolio, and strengthening of its nationwide infrastructure to support food security and supply-chain efficiency.

Social e-commerce platform Taager has expanded into Morocco, marking its first North African launch. Founded in 2019, Taager enables users to start online businesses without inventory or upfront costs. The move targets Morocco’s growing digital commerce market and follows the company’s recent $6.75M pre-Series B raise.

Türkiye’s digital asset platform Paribu has acquired Bahrain-based CoinMENA, the MENA region’s largest local crypto exchange, in a transaction worth up to $240M—the biggest fintech deal in Türkiye to date. The acquisition expands Paribu’s regulated footprint into the MENA region through CoinMENA’s licenses in Bahrain and Dubai, supporting its strategy for regional and compliance-driven growth.

UAE-based Byit Capital has raised $1.1M from A15, Beltone Holding, and angel investors. Founded in 2022, Byit offers an agent-first brokerage platform giving freelance brokers up to 90% of developer commissions. The funding will support strengthening UAE operations and expanding into Saudi Arabia and the wider Gulf.

Saudi gametech startup Qwacks has secured $480K in pre-seed funding from Merak Capital. Founded in 2024, Qwacks is building a unified technology layer for game development, including backend tools, AI-powered playtesting, and market intelligence. The funding will support expanding its tech stack and serving more game studios across Saudi Arabia and the region.

Qadi, a UAE-based regtech startup, has raised a pre-seed round led by Incubayt and emerged from stealth. Founded in 2025, Qadi turns local laws and regulations into AI agents that automate compliance workflows for law firms and financial institutions across MENAT. The funding will support team expansion and the platform’s rollout across the GCC.

Trendle, the parent company of MASAHA, has closed its second Seed round at a $1.5M valuation, with participation from Fifty Studios Holding and angel investors. Founded in 2022, MASAHA is a tech platform digitising and automating the tailoring sector using AI-driven solutions. The funds will support product enhancements, operational growth, and geographic expansion across the GCC in 2026–2027.

Impact46 has led a $1M round in Hypemasters, a global strategy game studio behind World War Armies, with participation from GEM Capital. The Abu Dhabi–based developer will use the funding to expand regionally and advance its next generation of competitive strategy games.

See you next week with more market updates and ecosystem highlights.