Join us on a journey of learning together while we share our thoughts and lessons learned.

The best deals don’t “go to market.” They move through people. If you’ve been around venture long enough, you know that most of the best deals show up in DMs, in group chats, in quiet introductions, or in “you should meet this person” messages sent at midnight. The best deals move the same way trust moves: through people who have earned the right to recommend other people.

Startups don’t just enter markets; they turn them upside down. The most successful ones don’t aim to beat the competition; they create entirely new markets where none existed before.

There’s a long-standing belief in startups that every tech company must have a CTO co-founder, someone with deep technical expertise who builds the product from day one. For many investors, the absence of a technical co-founder raises an immediate red flag.

Gross margin is one of the most telling indicators of a company’s long-term potential. While revenue growth often captures headlines, investors globally use gross margin to assess whether a business can scale sustainably, generate operating leverage, and ultimately produce meaningful returns.

Quantum Waves Will Quietly Kill Some AI Startups

Quantum computing's 3 stages will reshape AI, separating data-driven winners from hardware-trapped pretenders. A VC view.

In the VC space, we often see less excitement around B2C startups, and for valid reasons: higher customer acquisition costs, greater difficulty in retention, and more volatile demand compared to B2B businesses. But if these factors increase risk, the real question is whether B2C companies have historically generated returns large enough to justify taking that risk.

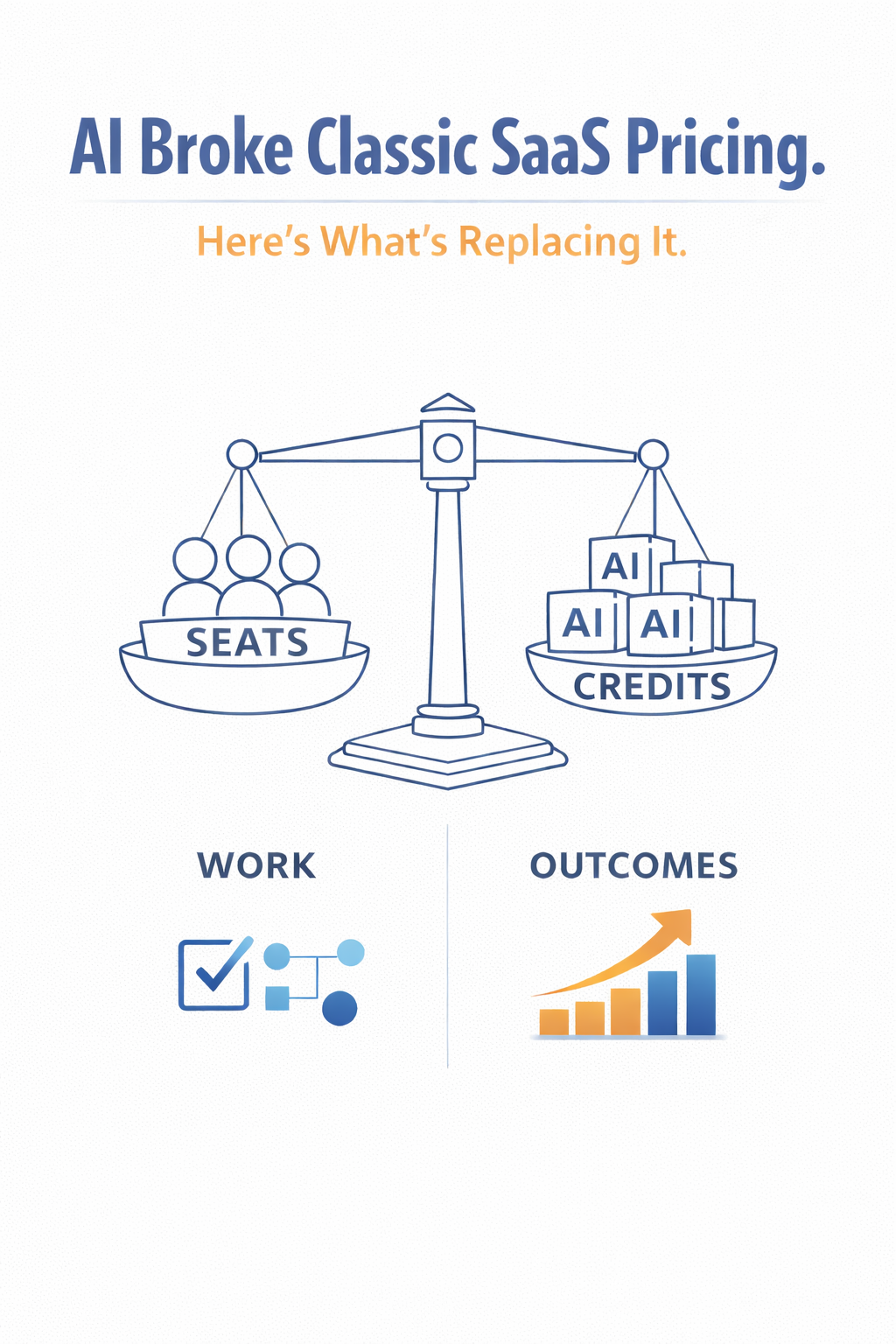

SaaS is evolving fast. From the investor seat, one pattern keeps showing up: classic SaaS pricing breaks in AI. Founders are adapting with new business models, and we’re learning from those experiments in real time.

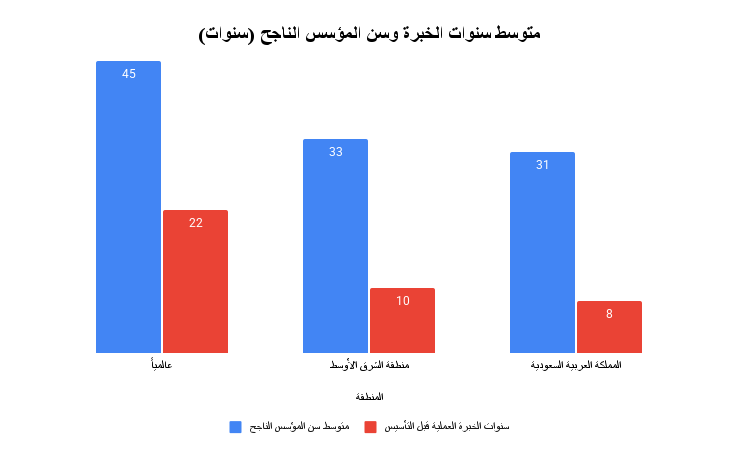

It is often said that most unicorns in Saudi Arabia today are B2C, and in many ways this is a fair observation. Consumer businesses naturally show traction faster. User growth is immediate, behavior change is visible, and scale can be measured quickly through downloads, transactions, and market share. B2C companies speak the language of speed, and speed is always more noticeable

Every startup begins with optimism. Yet, despite unprecedented access to capital, tools, and talent, the majority of startups still fail. This is not due to a lack of ambition or effort. Extensive research and failure analyses show that startup failure is highly patterned and, in many cases, preventable.

For more than a decade, cloud-based SaaS platforms have dominated startup narratives and investment theses. However, not all high-growth software companies achieve scale through cloud delivery alone. In highly regulated and security-sensitive sectors, on-premise deployment continues to play a critical role, driven by requirements around data sovereignty, regulatory compliance, and institutional trust.

Everyone has access to the same headlines. The real difference is who upgrades their mental models fast enough to recognize what matters, before it gets packaged into a narrative, turned into a buzzword, and priced in.

Venture capital trained us to see the startup world in two buckets: “lifestyle” versus “high growth.” That two-bucket model used to be helpful. Now it’s limiting. Not because VC is wrong, but because technology is changing the shape of what a “good company” looks like. The future isn’t only unicorns. It’s also upgraded “lifestyle” businesses that distribute cash, as AI makes software cheaper.

WhatsApp has evolved beyond a messaging platform into a powerful channel for business consumer interaction.

Last week wasn’t about metrics or portfolios. It was about people. Founder’s Day was a reminder that clarity, judgment, and real advice still come from human connection, not from dashboards or algorithms.

Juniors who rise fast in venture capital don’t just execute tasks; they master the fund’s two wings. First comes the Founders wing, where building real track records earns you credibility. Then comes the Limited Partner (LP) side, where proven results translate into influence.

In venture capital, one phrase shows up in almost every partner meeting: “What’s our ownership?”

For years, VCs have been trained to think that if you don’t own 10–20%, you’re not really in the deal. But is that always true? And in a world of larger rounds, competitive syndicates, secondaries, and multi-asset strategies… how much should a VC really care about ownership %?

Short answer: You should care about ownership — but you should care about fund outcomes and influence first, and treat ownership % as a tool, not a religion.

Let’s unpack this with some simple math.

Today, we hear the debate every day: are we in an AI bubble now? Some say yes, pointing to trillion-dollar valuations on unproven revenue; others disagree, citing real productivity gains. But the real question investors should ask is: If we are in an AI bubble, what traits will help companies survive and continue growing after the burst?

Where MENA VC Funds Actually Live: Cayman vs. Home Turf (2019–2025 Trends)

In the early days of any new technology, almost everyone operating at the edge gets called a “tech company.” Then the tools mature, infrastructure improves, and what used to be a moat quietly becomes a commodity.

With the rise of AI hype, we hear it everywhere. Founders pitch themselves as AI-first or AI-native. The labels sound impressive, but what do they actually mean? And more importantly, what distinguishes companies that merely use AI from those fundamentally built on it?

Raising capital can shape the entire future of a startup, but before term sheets, KPIs, and financial models, there is one moment that sets everything in motion.

In the early days of any new technology, almost everyone operating at the edge gets called a “tech company.” Then the tools mature, infrastructure improves, and what used to be a moat quietly becomes a commodity.

From the beginning, finance was my first and only choice. It’s a field that connects the present to the future, a language of numbers that helps you understand the world and shape what comes next.

Studying actuarial science turned out to be one of the best decisions I made early in my career. Even though most people associate the field with insurance, it gave me a strong foundation that eventually led me into investment analysis.

If you’re a founder, an angel investor, a fellow VC, or an LP, we’d love to hear from you. Tell us what excites you. We believe in long-term partnerships.

Contact US

We Would Love To Hear From You

Newsletter

Join our newsletter for exclusive Market Watch insights, podcasts, founder stories, in addition to our thoughts, market maps, and trend analyses.