Where MENA VC Funds Actually Live: Cayman vs. Home Turf

Cayman Islands

In 2019, Most Funds Were Cayman-Based

If you walked through a MENA fund’s legal docs in 2019, odds were overwhelming it was domiciled in the Cayman Islands.

Cayman ticked every box: global LP appetite, zero tax, speedy setup, and a “safe” reputation for big international capital.

Transparent data on exact percentages is missing, but every law firm and banker called Cayman the hands-down favorite.

2020–2023: UAE’s DIFC and ADGM Break Up Cayman’s Monopoly

DIFC (Dubai) and ADGM (Abu Dhabi) Free Zones changed the script.

Executives, local LPs, and new regulatory perks made onshore set-up attractive.

ADGM—just 2 funds a few years ago, hosts 209 funds and 154 managers by mid-2025, with total assets up 42% year-on-year.

DIFC fattened its wallet to nearly $700B AUM by early 2024, with hundreds of funds and asset managers.

Bottom line: The flow of new MENA-focused funds is now split, many are still Cayman, but a surging share is going to DIFC and ADGM.

2024–2025: Saudi CMA Emerges as the New Onshore Giant

Saudi Arabia, always a big startup spender, finally built fund infrastructure at scale.

Investment funds soared from 607 funds in 2019 to 1,549 funds in 2024, with private and VC funds leading the charge.

In 2025, 56% of all MENA VC funding landed in Saudi deals; everyone’s setting up a CMA vehicle (or dual home, ex: Cayman+Riyadh).

Market watchers say Saudi doesn’t just attract VC, it keeps the money local now too.

From left: PIF tower, Abu Dhabi, CMA, KAFD, Dubai

Today, What’s the Real Split?

No public, hard percentages say “60% Cayman, 20% UAE, 20% Saudi.” Providers and legal experts cite Cayman as still leading (especially for big, pan-regional, or global funds), but the growth and momentum is clearly with DIFC, ADGM, and Saudi CMA for MENA-only or Gulf-heavy strategies.

Instead of one "right" home, top managers increasingly run a mix:

Still Cayman for global LPs and flexibility.

UAE for GCC exposure, family office trust, and regulatory nimbleness.

Saudi for Vision 2030 capital, onshore access, and local partnerships.

If you had to paint a picture for 2025:

Maiden/legacy funds = probably Cayman

New MENA-only or regional play = likely DIFC/ADGM or Saudi CMA

Cross-border/institutional = still mixed, but the center of gravity has moved closer to home

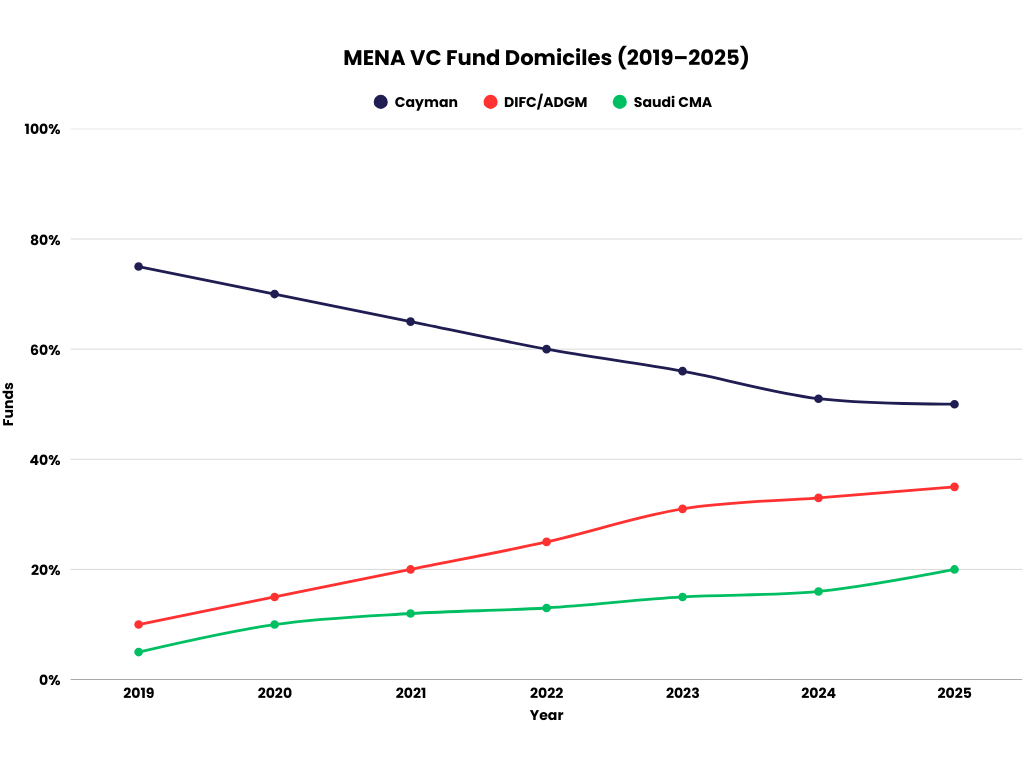

Visual Snapshot (2019-2025):

Trend of MENA Funds Domiciles (2019-2025)

If your fund or partner still lives offshore, that’s normal. But the next round? Home stretch is getting crowded.